For brands, the Super Bowl isn’t just another platform for their ads. It’s much bigger than that – it’s an opportunity to become part of culture, connected with eagerly engaged audiences through smart use of celebrities, creativity, and pop-culture relevance. We’ve seen plenty of brands take advantage, whether it be the ingenious deployment of Michael Cera by CeraVe, or Martin Scorsese depicting an alien invasion for Squarespace.

Each and every Super Bowl, the visuals pop off our screens. But what about the other half of the experience: The audio?

In 2023 a report into Super Bowl music was published by SoStereo, the platform which connects brands to real music by real artists. Their research uncovered how, strangely, Super Bowl advertisers were disproportionately drawn towards classical music – despite this being one of the least effective (and least likeable) genres for audiences. This year, SoStereo set out to update their research based on the 2024 Super Bowl, with some fascinating results.

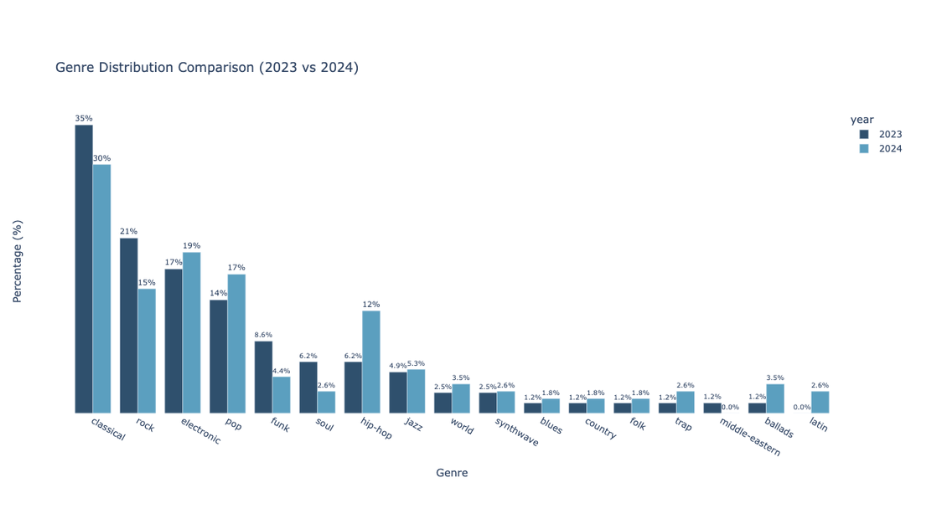

Firstly, that reliance on classical music has lessened – but not by much. Last year classical music accounted for 35% of what audiences heard from Big Game ads. This year, it’s dipped ever so slightly down to 30%. That’s still enough to make it comfortably the most popular genre for music in Super Bowl ads. You might ask why SoStereo thinks that’s out of touch with audience listening habits, and it’s because classical music accounts for just 1% of music streaming share. That’s good for 9th place according to Statista’s streaming share analysis. So the question remains why advertisers are so out of sync with what audiences like to listen to, if the goal of advertising is to entertain rather than interrupt.

On the other hand, we saw a doubling in the representation of HipHop and R&B, which jumped from 6% last year to 12% this year. That’s an improvement considering how those genres more accurately reflect the listening habits of Americans, but it still doesn’t meet audiences where they are. After all, HipHop and R&B artists accounted for over a fifth – 27% – of the US’ streaming consumption last year, making it the most popular genre.

Of course, numbers never quite tell the whole story. In many instances, classical music helped inform the set-up of ads before an emotional payoff scored by uplifting pop or rock later on. However, if we were to include these spots, the number would jump to 40% of ads that featured classical music in some capacity. So it’s still jarring to see such a level of popularity for a genre which doesn’t feature highly on the list of modern consumers’ listening preferences.

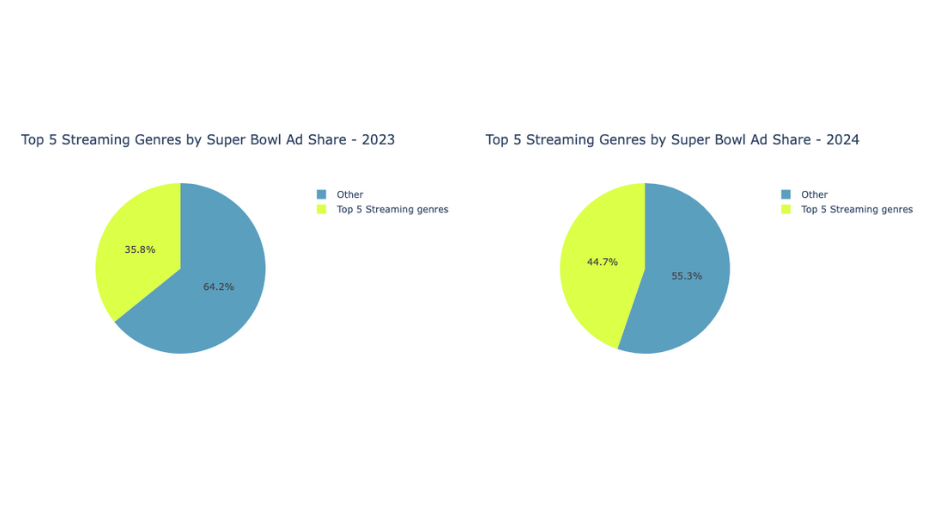

Of the top five listened-to genres in the US (HipHop, Rock, Pop, Latin, Country), their share of use on SuperBowl ads saw an uptick from 35% in 2023 to 44% in 2024. Again, still well below their relative streaming numbers (72%).

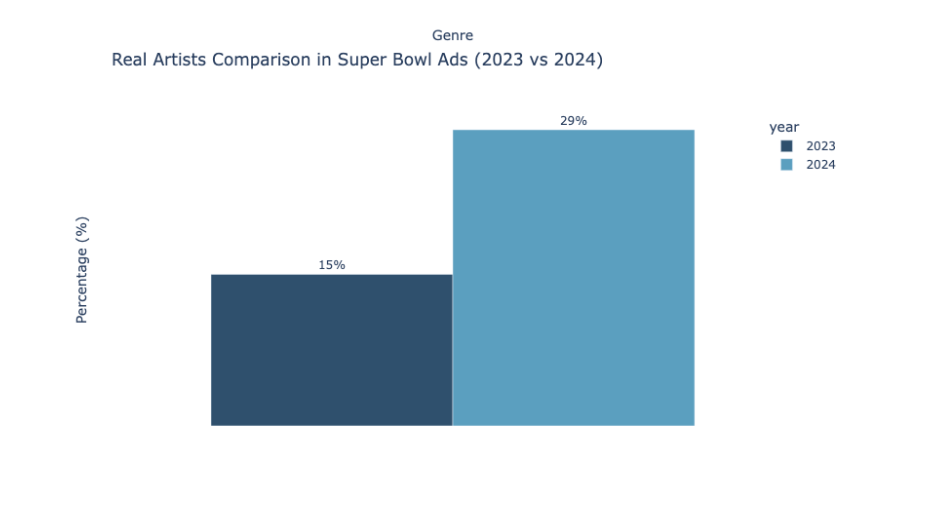

A positive trend identified in this year’s Big Game ads was a slight uptick in real music from real artists. 15% of ads featured real artists’ music last year, in comparison to 29% in 2024. But still, this means that over two thirds of Super Bowl ads did not use real artists’ music; in other words this points to ~71% of ads using original composition or – even worse – stock music. Given we know that there’s a direct correlation between music and an ad’s effectiveness, memorability, and distinctiveness, this feels like something of an oversight and missed opportunity. We’ve seen brands step up with ever more ambitious celebrity endorsements and ideas – so why isn’t music more of a ubiquitous priority for Super Bowl ads?

Diving deeper, three of the biggest winners in the automotive category were Kia, BMW and Volkswagen, which all happened to feature music by real artists. Real artists’ music accounted for 66% of ad share in the category, far above the baseline and perhaps one of the reasons that the automotive category stood above the rest in post-Super Bowl accolades. Like aAutomotive, beverages (including beer) also indexed higher in their use of real artist music with Mt. Dew leveraging BBNO$, Coors Light using the classic “Love Train” by The O’Jays, Michelob & The Drifters, Stok Cold Brew & Luke Richards, Bud Light & Steppenworlf, Budweiser & the Band, and Poppi and Yazoo. These account for 87% of ad share. As with automotive, it seems that certain categories use music as a competitive advantage and differentiator. As more competitors use music strategically, it forces them to do so well – or risk getting left behind in the mind of their consumers.

“While leveraging classical film scores has been a historical standard in advertising, and of course still has a place in our craft, I think the data all too conclusively shows too big a gap between what is used and what audiences respond to” says Salo Sterental, cofounder of SoStereo. “Our job should be to understand the ‘why’ of this trend so we can push to innovate, push the envelope of music in advertising, and get closer to a more representative place. This way we can truly match our work with what our audiences like and want, so we can win their attention.”

It seems as though there’s still a lot of space for brands in which brands can step up and make connections with their audiences through real, authentic music that means something to them. Whilst 2024’s Super Bowl ads saw a few steps in this direction, there remains more to do.